Bogdan Andriitsev,

business development, BG Ukraine, (member of BARAN GROUP, Ltd)

Ukraine is celebrating 30 years of independence. It was a difficult period, full of some successes and regular upheavals. In economic terms, the transformation from a planned closed system to a market globalized economy has continued. Sometimes the transition was controlled and not too painful, but in most cases it happened spontaneously cuasing numerous losses. Shipbuilding is one of the most affected industries. According to the Ukrsudprom Association, if in the early 1990s 93,000 people worked at Ukrainian shipyards (including those located in the Crimea), and in 1991 73 complete ships were sold (at the peak of development the industry was building 100-120 ships) , today the number of employees is over 6 thousand people, and in 2020 only 21 ships and one vessel were built. Currently, the potential of Ukrainian shipbuilding is far from being realized. This repeatedly raises the question: what should to be done in order to revive the industry?

LOST POTENTIAL

No industry can operate without sufficient demand for its products, even purely potential. Significant scale of Ukrainian shipbuilding in Soviet times was due to the size of the USSR economy, its closure and the significant weight of Ukrainian factories in it, which, according to the Ministry of Economic Development, provided about 30% of the Union’s shipbuilding products. With the country’s disintegration, Ukraine lost control of the lion’s share of its water transport flows, Russia focused on import substitution, including shipbuilding, and after the annexation of Crimea, the Russian market became completely lost to Ukraine, so did the industrial cooperation with its enterprises. This is the first important factor limiting the potential of Ukrainian shipbuilding.

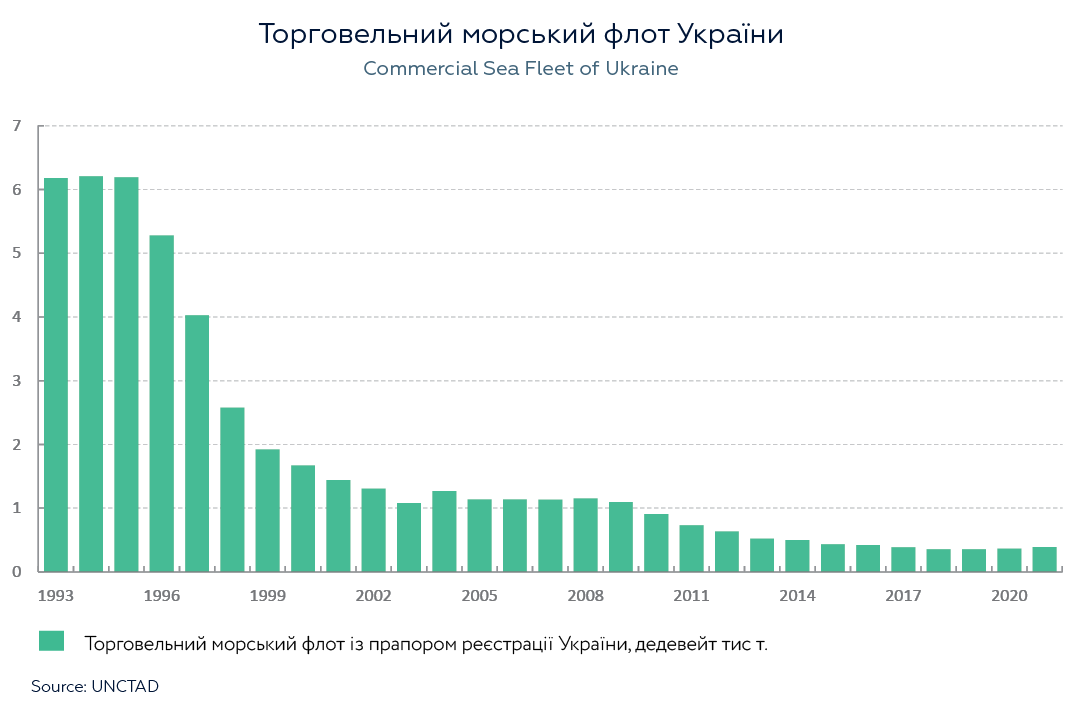

The second factor is the loss of Ukraine’s commercial fleet and competitive positions by Ukrainian maritime transport. According to UNCTAD, in 1993 our country had a merchant navy with a capacity of 6.2 million tons (0.9% of the world fleet, see Figure 1), then in 2021 this figure dropped to 391 thousand tons (only 0.018%) . There are many reasons, ranging from the theft of assets of the Black Sea Shipping Company, which has practically gone bankrupt, to global trends such as the registration of ships under the flags of offshore jurisdictions (Panama, Liberia, the Marshall Islands, etc.).

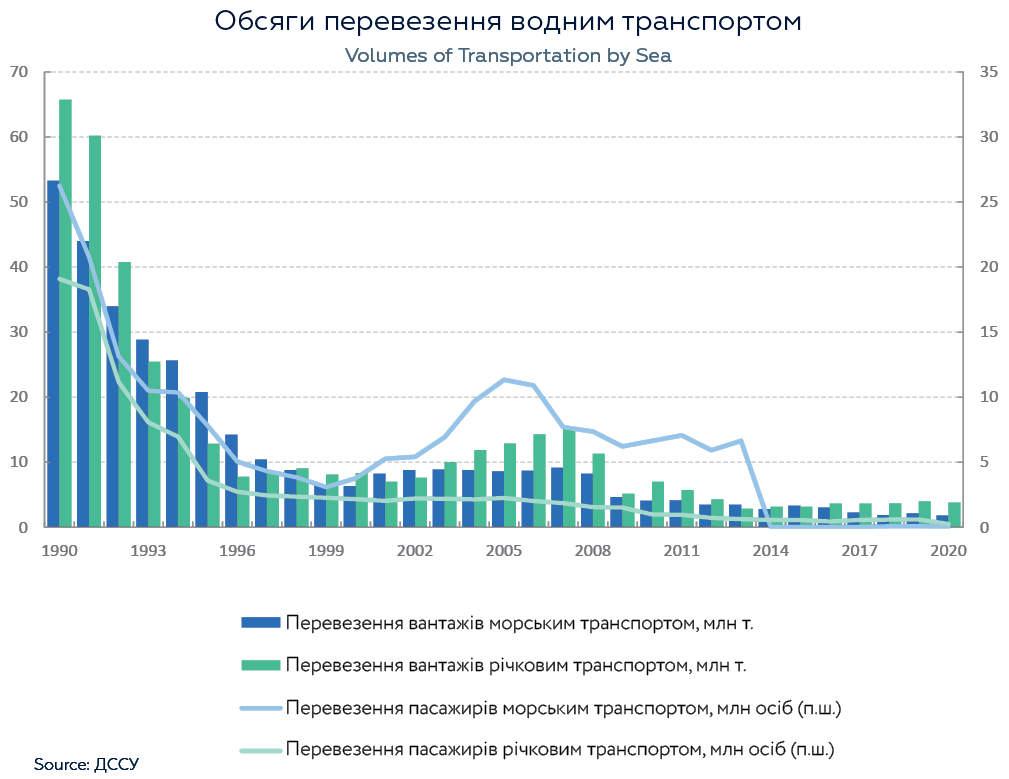

he consequence of this factor is a rapid decrease in the volume of maritime transport in Ukraine (see Chart 2). During the 30 years of independence, the volume of cargo transported by Ukrainian sea transport has decreased by 29 times, and the number of passengers by 499 times! During this period, Ukraine’s GDP fell by 37% — the difference is striking. In 1990, maritime transport accounted for 0.85% of all Ukrainian transport for freight and 0.18% for passenger transport, in 2020 these figures decreased to 0.11% and 0.002%, respectively. Today, Ukraine’s maritime transport carries only 1.1% of the cargo processed by Ukrainian seaports. And this share is chronically declining, even for several relatively successful years before the 2008-2009 crisis.

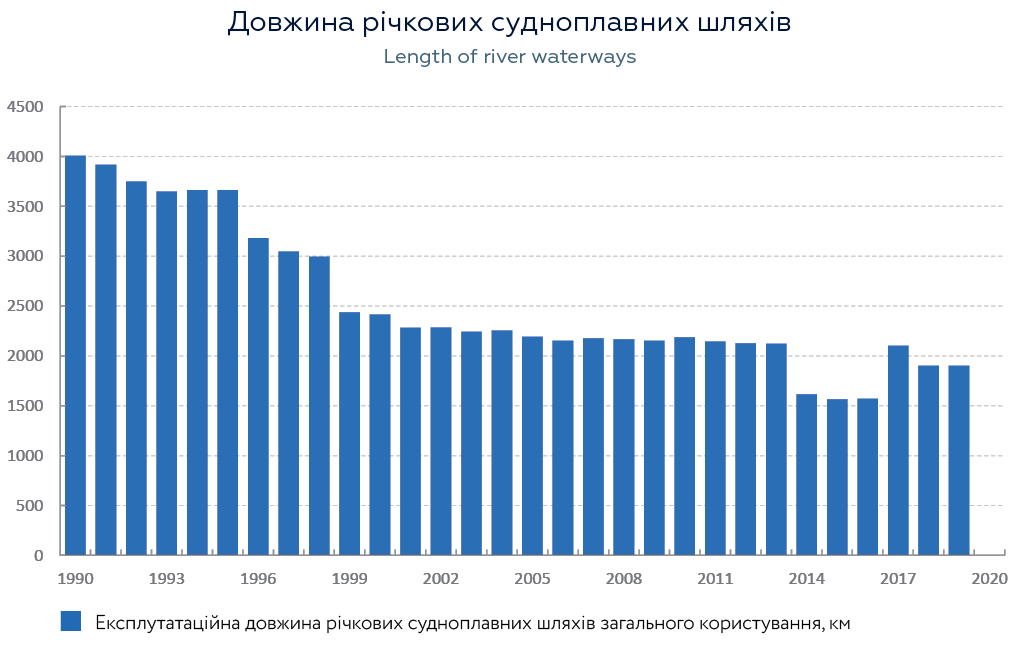

And the third factor is the degradation of inland waterway infrastructure, which is inextricably linked to the decline in inland waterway transport (see Charts 2-3). According to the State Statistics Service, during the period of independence, the operational length of Ukraine’s public waterways has more than halved. The reasons are the obsolescence of navigable locks, the siltation of rivers, which makes navigation dangerous and expensive, as well as the long period of economic ruin, due to which Ukraine until recently had an acute shortage of financial, including budgetary, resources to maintain river transport infrastructure. As a result, during the 30 years of independence, the volume of cargo transportation by river transport has decreased by 17 times, passengers — 74 times. Therefore, although, according to the State Statistics Service, there are 1,401 river vessels in Ukraine (data for 2017, no more recent ones), their number is surplus relative to the current needs of river transport, so the fleet is not renewed, aging and does not meet many modern requirements for water transport.

In the current situation, there are simply no immediate preconditions to provide Ukrainian shipbuilders with a significant uniform level of workload in the short term, not to mention the conditions for development. Therefore, Ukrainian shipyards are mostly forced to interrupt sporadic orders and shift the emphasis in their activities to ship repair, not construction.

There is a need to create demand for the shipbuilding industry — this will not be possible without systematic, long-term work and multi-level involvement of the state.

STRATEGIC OPPORTUNITIES

Of course, the annexation of Crimea and the war in Donbass closed the Russian market for Ukrainian shipbuilders and the possibility of cooperation with Russian component manufacturers. But it also had a number of positive side effects. Firstly, the Ukrainian state realized that it needed a capable navy. According to the Ukrsudprom association, some ships for our country will be built at shipyards in Great Britain, France, Turkey and the United States, and others at Ukrainian shipyards. Of course, we would like Ukrainian shipyards to receive a much larger share of these orders, but judging by the fact that the state level is seriously considering the need to build a mosquito navy in Ukraine, these are not the last orders for domestic producers. In addition, close cooperation with foreign manufacturers according to NATO standards opens good prospects for Ukraine for large-scale production cooperation.

Second, the loss of the Russian market should be translated into persistent attempts to include our shipbuilders in European and North American production chains. The example of the aviation industry, which in a few years assembled the first serial An-178 without Russian parts, on which it was extremely dependent, should be taken up. The intensive experience of cooperation with European manufacturers, for which Ukraine built more than one hull of large-tonnage vessels in the 2000s, needs to be expanded. For such cooperation we have the main necessary competitive advantage — a relatively low cost of labor.

Third, Europeans and Americans are actively involved in the development of Ukraine’s water transport: in 2016, the US Army Corps of Engineers assessed engineering structures on the Dnieper, the UN Economic Commission for Europe became interested in the state of navigable rivers, the EBRD and the EIB signaled interest in financing river connections. Black and Baltic Seas through the Dnieper, Pripyat, Western Bug and Vistula, as well as intermodal transport using inland waterways of Ukraine. Ultimately, such cooperation should be used to increase demand for domestic vessels and attract foreign donors to finance their purchase.

The most reliable opportunity for the emergence of system orders for Ukrainian-made vessels is the development of river transport. Today, due to the neglected infrastructure of inland waterways, the cost of river transportation is uncompetitive compared to other modes of transport. However, potentially river transport is the most efficient in both economic and environmental terms — this is proven by world practice, in Ukraine the volume of transported river transport is 0.24%, but in other countries the share is much higher: the Netherlands — 47%, USA — 40%, Romania — 29%. The economy component is simple: per unit of fuel consumed, river transport can transport 2.5 times more cargo than road, and 30% more than rail. In addition, according to the Ministry of Infrastructure, 1 million tons of cargo transported by the river reduces the cost of road repairs by 1 billion UAH over 4 years. Therefore, industry experts unanimously recognize the high potential of river freight, whose estimates range from 20-40 million tons for the next few years to 60-80 million tons for the strategic perspective. One of the main proofs of the reality of this potential is the experience of the agricultural company Nibulon, which has deepened the bottom of the Southern Bug River on its own, has reached a good scale of river fleet construction, and now evolve. To realize this potential nationwide, inland waterway infrastructure needs to be restored and developed. There are various estimates of the cost of this challenge, the largest of which, which appears in the draft «Strategy for the development of inland water transport until 2031», is UAH 7 billion — a trifle compared to direct and indirect effects.

In order to create a stable demand for Ukrainian-made vessels from maritime transport field, a number of incentives need to be introduced. It is not only and not so much a matter of attracting ships under the flag of Ukraine. This practice also exists in the world, in particular, for this purpose some countries create convenient International Register of Ships, others exempt registered shipowners from paying taxes and duties. However, here we have to compete with offshore, ie jurisdictions with extremely low levels of taxation, and this does not guarantee a favorable outcome for domestic shipbuilding. It is much more important to make a Ukrainian ship as accessible as possible for a potential shipowner. And here are two points to look out for. First, today the products of Ukrainian shipbuilders simply lose price competition to the leading countries in the industry (South Korea, China, Japan) simply because irregular work does not allow to minimize fixed costs and modernize production to the level of good world standards. In many cases, even a relatively very low level of wages does not compensate for this shortcoming. Second, the leading countries have a whole system of government measures to support the industry, ranging from reducing the tax burden and reducing funding for manufacturers, ending with concessional lending to shipowners, which allows them to pay the lion’s share of the cost of the vessel only when it is already operating and generating cash flow. . Therefore, in order to increase the demand for Ukrainian ships from maritime transport, it is necessary to provide shipyards with rhythmic orders and to adopt the best examples of international experience in stimulating shipbuilding.

The role of the state

There have been precedents in the history of independent Ukraine for the introduction of state support for shipbuilding. In the early 2000s, Ukrainian shipyards were exempted from land fees, import duties and VAT on imported raw materials and materials not produced in Ukraine, free economic zones were established for some factories, and so on. However, to the extent that these incentives expired or were depleted due to changes in relevant legislation, Ukrainian shipbuilding was rapidly losing momentum. The main reason is that the country has not formed a stable systemic demand for shipbuilding products. Several opportunities for the state follow from past experience.

Firstly, the state can invest more intensively in building a navy. Over the past 10 years, state budget expenditures on the Ministry of Defense have increased 9.7 times to almost UAH 120 billion. Of this amount, it is quite possible to allocate several billion a year for the construction of warships — this will increase the production of Ukrainian shipyards by a quarter, half or even several times. If the amount of contracts for the purchase of foreign warships is a multiple of hundreds of millions of dollars, then proportional amounts can be spent on the products of domestic producers.

Secondly, the state must create conditions for the development of inland waterways. Much has been done in this direction. The law «On inland water transport of Ukraine» was adopted. It contains favorable provisions. For example, «the use of inland waterways for navigation is free of charge» or «Transportation in cabotage flights between river (sea) ports on the inland waterways of Ukraine may be carried out by Ukrainian vessels or foreign vessels owned by entities registered in Ukraine». A rather progressive draft «Strategy for the Development of Inland Water Transport of Ukraine until 2031» has been prepared. Among the expected results of its implementation is the achievement by 2030 of the annual construction of 30 units of modern and ecological fleet that meets EU standards. Now all these texts must be effectively implemented in practice.

Thirdly, the state must invest much more in the development of inland waterways. Today, more than 600 times more is spent on road repairs from the state budget than on all water transport in general, although the difference in the volume of road and water transport is much smaller, not to mention the ratio of their potential. The law and strategy create an Inland Waterways Fund to finance the development of the relevant infrastructure, but the sources of this fund are not yet clear. foreign donors to fill this fund.

In the fourth place, the state should create a favorable regime for shipowners to register their business and vessels in Ukraine and buy Ukrainian-made vessels. In addition to maintaining the International Register of Ships, the possibility of state lending to shipowners to purchase a Ukrainian-made vessel secured by it with the possibility of crediting tax liabilities that will arise during its operation, such as repayment of such credit, etc. This can be done with the resources of the specified fund, Export Credit Agency or other institution. Shipowners should be interested in buying and registering vessels in Ukraine, which is not yet the case.

In the fifth place, only after the realization of all these opportunities, the state can introduce direct incentives for shipyards by creating special tax, customs, financial conditions for their work in line with the best world practices. There is no need to invent new thing: you just need to study international experience and compare it with domestic conditions. Only then will the industry receive an irreversible boost to development.

Stimulating the development of water transport should go hand in hand with the realization that one job created in shipbuilding causes the emergence, according to various estimates, of 5-10 jobs in related sectors of the economy. This is a colossal multiplier effect, which, together with indirect effects such as the preservation of roads and the environment, makes even those projects that, at first glance, do not have a quick payback, extremely profitable for the country.