Time-charter market

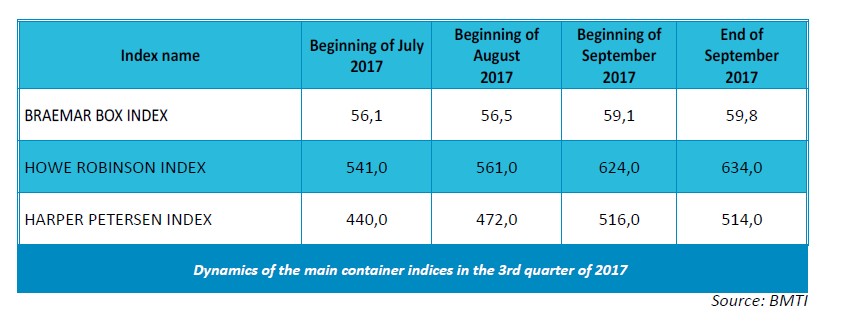

Unlike the previous quarter, in the third quarter of 2017 there were no sharp changes in the market of time-charter tonnage, as evidenced by the relatively stable dynamics of the main freight indexes. Thus, BRAEMAR BOX INDEX in the period under review increased from 56.1 to 59.8 points, or 6.6%, HOWE ROBINSON INDEX — from 541 to 634 points or 17.2%, HARPER PETERSEN INDEX — from 440 to 514 points or by 16.8%. But the smallest increase in the third quarter showed the ConTex index calculated by the Hamburg brokers, which increased from 384 to 400 points (+ 4.2%).

At the same time, the annual time-charter rates for feeder containerships with capacity of 1100 TEU increased by 210 USD / day or 3.3%, and 1700 TEU — at 689 USD / day or 9.4%. For container ships with capacity of 2500 TEU, the rates remained at the same level, 2700 TEU – increased by 198 USD / day or 2.2%, and 3500 TEU, on the contrary, decreased by 210 USD / day or 2.4%. And only for container ships with capacity of 4250 TEU, the increase in rates in the third quarter was a solid 1417 USD / day or 18.7%.

An even greater variety of time-charter rates is observed on an annual basis. If for containerships with capacity of 4250 TEU compared to the end of September last year, the rates increased by 4351 USD / day or almost twice, for vessels with capacity of 1100 TEU they lost about 100 USD / day. The larger feeder containerships with capacity of 1700 TEU increased the rates by 1188 USD / day or 17.5%, while for vessels with capacity of 2500-3500 TEU, the rates increased by 3000-3300 USD / day or more than a half times. Thus, it can be stated that the market of time-charter container tonnage in the third quarter of 2017 was dominated by a slight upward trend, which allowed to keep rates for container ships with capacity of 2500-4250 TEU at a level that is one and a half to two times higher than that of the similar one the last year.

At the same time, a relatively small difference in the daily earnings of containerships of various capacities, which did not exceed 2744 USD / day at the end of September, draws attention. This led to the fact that in terms of container capacity, container ships at 1100 TEU earned 6.0 USD / day, and 4250 TEU — only 2.11 USD / day, almost three times less. However, at the end of the 3rd quarter of last year, this skew was even more significant — 6.11 and 1.09 USD / day respectively.

As real leases of the period under consideration, we can quote the annual time charter of the container vessel Julie Delmes with capacity of 2207 TEU built in 2002, owned by Global Ship Lease. The charterer of this vessel at a rate of 7800 USD / day was the company CMA CGM.

In addition, CMA CGM took a Domaino container ship with capacity of 3,739 TEU built in 2001 for a duration of 8-11 months. The rate in this case was 8500 USD / day minus 3.5% commission to third parties. It is noteworthy that in the previous charter from the company Nile Dutch Africa Line the rate was only 6000 USD / day (minus the commission of 5%). Another container belonging to Diana Containerships Pamina container with capacity of 5042 TEU built in 2005 was chartered by OOCL for a period of 7-12 months at a rate of 9500 USD / day (minus the commission of 3.75%).

Linear transportation

The rates of the linear tariffs in the 3rd quarter of 2017, unlike the time-charter ones, could not keep from falling, despite the coming season of peak demand for container shipments.

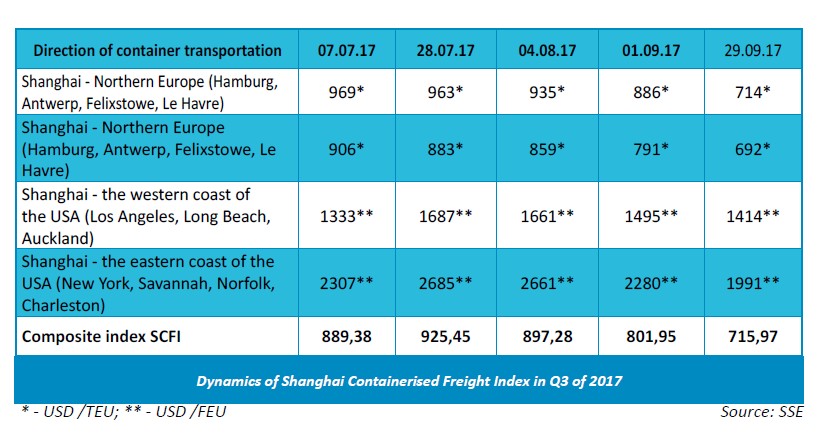

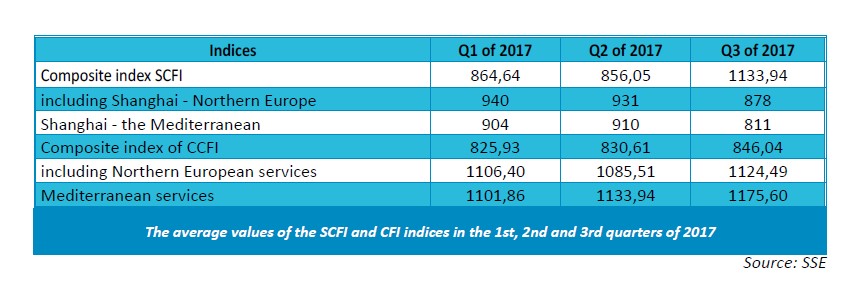

The composite SCFI index, calculated by the Shanghai Freight Exchange (SSE) for spot shipments, which at the beginning of July was 889.38 points, fell to 715.92 points or 19.5% by the end of September. At the same time, during the period under review, in the direction of Shanghai-North Europe, the rates fell from 969 to 714 USD / TEU (-26.3%), and in the Mediterranean — from 9.6 to 692 USD / TEU (-23.6%).

In the North American directions of transportation losses were not so significant. In the direction of Shanghai – East Coast of the USA spot rates fell from 2307 to 1991 USD / FEU (-13.7%), but on the West Coast of the USA they even grew slightly. Another difference between the North American destinations from transport to Northern Europe and the Mediterranean is that at the end of July, as a result of the introduction of most general lines of interest rate increases (GRI), rates here rose by 350-380 USD / FEU. However, during August-September, the rates began to decline rapidly, especially at East Coast of the USA.

Compared with the end of September 2016 this year, spot rates in the direction of Shanghai – Northern Europe turned out to be higher by only 15 USD / TEU or 2.1%, in the direction of Shanghai-Mediterranean the gap was much higher, amounting to 109 USD / TEU or 18.7%. At the same time spot rates in the direction of Shanghai – West Coast of the USA for the year decreased by 272 USD / FEU or 16.1%, and on the East Coast of the USA — 425 USD / FEU or 17,6%. Decrease in spot rates in the year-by-year context has affected the vast majority of other container shipments, for which the SCFI index is calculated.

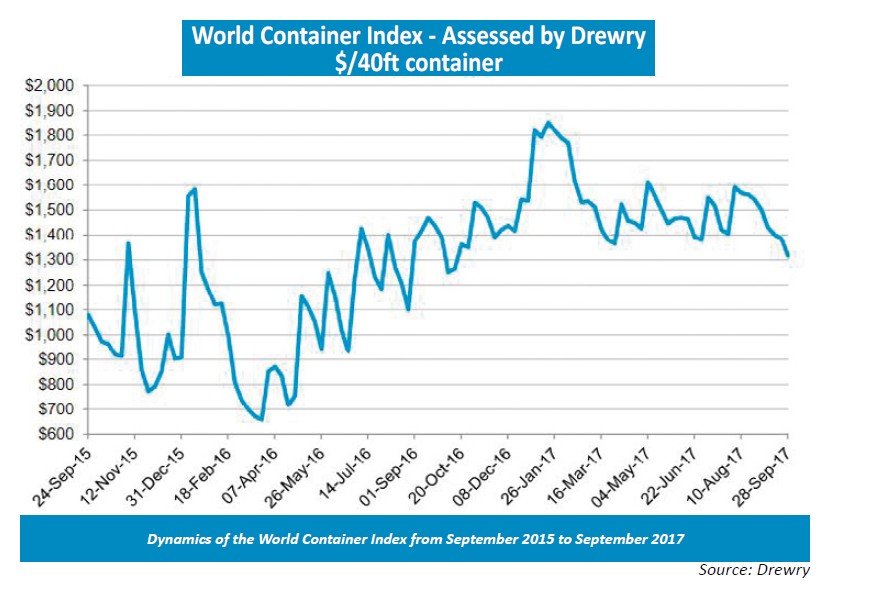

The calculated by Drewry for the eight major container shipments the World Container Index (WCI) declined from 1550 to 1318 points or 15% during the third quarter. At the end of September 2017, this indicator was 6% lower than a year earlier. Recall that according to Drewry in early July WCI was 9% higher than in the same period a year earlier. The average value of the WCI index for the 9 months of 2017 was USD 1527 / FEU, which is 6.2% below the average for the five-year period, amounting to USD 1,628 / FEU.

Returning to the third quarter of 2017, we note that the WCI index for the direction of Shanghai — Rotterdam fell from 1936 to 1397 USD / FEU or 27.8%, and for the direction of Shanghai — New York — from 2405 to 1981 USD / FEU or by 17.6%. That is, both the level and dynamics of the SCFI and WCI indices in the 3 rd quarter of 2017 almost completely coincide.

Another calculated SSE container index — CSFI, which is based not on spot, but contract rates could not resist the fall in the third quarter of 2017. Composite index of СCFI during the considered period decreased from 851.59 to 803.25 points or by 5.7%, which indicates a more sluggish decrease in contract rates compared to spot prices.

For North European services, the CFI index decreased from 1114.14 to 1069.96 points or by 4%, and on the Mediterranean more significantly — from 1221.71 to 1045.16 points or by 14.5%. For North American services, the CFI index increased by 1.0-2.0% during the third quarter, due to the already mentioned GRI. Thanks to this, the average level of СCFI in the third quarter of 2017 was slightly higher than in the previous two quarters, in contrast to the SCFI index, which tended to decrease from quarter to quarter.

The announced increases in their tariffs in the framework of GRI, PSS, FAK or CS did not help much the container lines to keep rates in the 3rd quarter. The last Congestion Surface was introduced by the OOCL line for the ports of Antwerp and Rotterdam in response to the complication of container transportation by barges between these ports and Germany via inland waterways, which caused barge operators to set their mark-ups due to their delays.

In conclusion of this section, we note that in vaddition to the direction of Shanghai — the ports of Northern Europe / Mediterranean, spot rates in late September were lower than last year. A year ago, rates rose sharply due to the loud collapse of the South Korean Hanjin Shipping (the tonnage contract was reduced, and the consequences of excessively low rates came to a halt when the movement of hundreds of thousands of containers with cargo stopped).

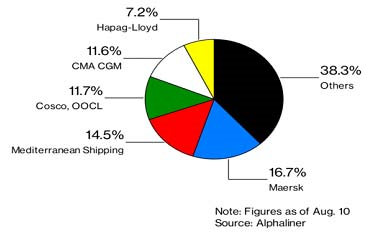

This year, spot rates declined despite a rather high demand in the peak season, completely losing the upward momentum given to them a year earlier. This decrease is due to the active commissioning of a new container tonnage of large capacity against the backdrop of a mass closure of factories in China (as part of the environmental protection program). That is, the increase in supply outweighs the growth in demand, which does not allow the lines to increase their tariffs. All attempts made by the lines in the period under consideration under one or another pretext (GRI, PSS, FAK, etc.) to increase the rates did not give anything. In addition, accelerated sharply in the past two years, consolidation among linear carriers, as well as the cascade effect as a result of the commissioning of mega containerships on the main directions of traffic have led to tighter competition, which did not fail to affect the level of rates, causing even some market players to once again raise the thesis about the beginning of a new round of freight wars.

Economy of container transportations

The financial and economic performance of container lines in the third quarter of 2017 is currently only calculated and specified, and will be published no earlier than the second half of November. However, there were data on the performance of linear operators in the 2nd quarter, which became the best for the linear carriers in the last two years. According to preliminary estimates by Drewry, the operating margin for the linear container market in the second quarter was 4% in the second quarter, and CMA CGM, whose data was not included in this analysis due to late provision of materials, was 8.9%.

Only four of the 16 container lines included in the Drewry analysis showed losses for the first half of the year, compared to the 12th year earlier, mainly due to the improvement of the market situation. The worst result among the lines included in the Drewry analysis was the operating loss of Hyundai Merchant Marine (HMM) of $ 227 million. Analysts explain this by the fact that HMM in order to restore volumes lost due to financial problems, offering customers significant discounts. As a result, the volume of HMM shipments increased by 46% in the second quarter, and revenue for one transported container decreased by 6%, which entailed the aforementioned losses. In addition to HMM, losses in the second quarter were received by the Japanese MOL and the Taiwanese Yang Ming.

The world’s largest Maersk Line reported a profit of $ 339 million in the second quarter against a net loss of $ 151 million a year earlier. According to the results of the first half of the year, the volume of Maersk Line traffic amounted to 10.6 million TEU, 5.6% more than in the same period last year. Together with the improved freight market, this allowed us to increase revenues in comparison with the first half of last year by 15.5% to USD 11.6 billion, and net profit to USD 273 million against a loss of USD 114 million a year back. Speaking about the consequences of cyberattacks, which affected this July Maersk Line, APM Terminals and Damco, the management of the group noted that they will affect the results of the third quarter, reducing them by about 200-300 million US dollars.

In the second quarter of 2017, CMA CGM received operating income of $ 472 million, almost double the $ 1 million ($ 252 million) figure for the first quarter, not to mention a loss of $ 81 million, USD by the results of the second quarter of 2016. The high indicators of the second quarter of 2017 contributed to the increase in revenue by 57% to 5.55 billion USD, thanks to the growth in traffic volumes (+ 33%) and higher rates (+12, 5%). The level of operating profitability in the second quarter, as already noted, reached 8.9%, which is one of the highest values among all linear carriers. Included in the CMA CGM in June 2016, NOL received in the second quarter of this year operating profit of $ 137 million, which is a significant contribution to the overall results of the group.

The company HAPAG-LLOYD, encouraged by the significantly improved financial results in the second quarter of 2017, for the first time since November 2015 (the beginning of stock quotes on the stock exchange), was thinking about paying dividends.

The return to profitability allowed many liner carriers to return to shipbuilding programs. Among the orders made in the 3rd quarter of 2017 for new buildings, the contracts signed by MSC and CMA CGM for the construction of megacontainer ships with capacity of 22 thousand TEU are the most noteworthy.

Marine analysts also pay attention to the extremely high activity of the second-hand container tonnage market during the past period of 2017. For 9 months, in 2017, 218 container carriers with a total deadweight of 9.6 million tons and a total value of 1.5 billion dollars were replaced. For the entire 2016, these indicators were respectively: 113 ships, 4.4 million tons and 1.16 billion dollars. Among the main reasons for such a high activity a large number of sales of ships of the bankrupt Hanjin Shipping and the collapse of the German KG-financing system, which also put a lot of ships belonging to KGhouses on the market can be noted.

Recall that South Korean Hanjin Shipping, once the 7th largest container carrier in the world, at the end of August last year appealed to the courts of various jurisdictions to protect against arrests (initiating the bankruptcy procedure), and in February 2017 the Seoul court called it bankrupt. Currently, the claims of the company’s creditors are being satisfied, which amount to no less than 10.5 billion US dollars. At the same time, all the Hanjin Shipping property sold makes it possible to refund only 220 million US dollars, i.е. only 2 cents per 1 dollar of debts.

Service modernization

After the launch of the new service system in the modernized structure of alliances of container carriers from April 1 this year not so much time passed and the main efforts of the linear operators were still aimed at the formation and further debugging of the work of this system. Nevertheless, in the third quarter of 2017, there were many reports of steps being taken by the lines to improve the work of existing or launch new services. First of all, the capacity building of the leading container carriers in the South American region gets the attention. So, CMA CGM in late September and early October launched

the services SAFRAN and SIRIUS, connecting the eastern coast of South America with Northern Europe and the Mediterranean, respectively. The rotation of the ports of call on the SAFRAN service: Rotterdam — London — Hamburg — Antwerp – Le Havre — Algeciras — Santos — Paranagua – Buenos Aires — Montevideo — Itapoa — Paranagua – Santos — Pesame — Tangier and on the SIRIUS service: Malta — Genoa — Barcelona — Valencia — Algeciras — El Salvador — Itagua — Santos — Itapoa — Buenos Aires — Rio Grande — Itajaia — Itapoa — Santos – Itagua — Tangier — Algeciras. Both services are launched within the framework of the CMA development strategy in the CMA CGM in the South American region. Approximately at the same time and with a very similar rotation of ports of call, MSC in cooperation with HAPAG-LLOYD announced the opening of a new joint service in the direction of Northern Europe — South America, which will operate nine container ships with capacity of 9000 TEU with 1,325 refrigerated outlets. This service provides for the following rotation of the ports of call: Rotterdam — London – Bremerhofen — Hamburg — Antwerp — Le Havre — Sines – Rio Sepetiba — Santos — Navegantes — Buenos Aires — Motuevideo — Rio Grande — Navegantes — Paranagua — Santos Rio Sepetiba — Salvador — Peso — Rotterdam. In HAPAG-LLOYD this route was called ECX Service, and MSC — NWC / SAEC Service.

The remaining changes on the line services in the period under review were of a local-regional nature. In the second half of August, CMA CGM launched a direct weekly Black Sea Med Express (BSME) service linking the ports of call in the Black and Aegean seas with Morocco and Algeria. Service rotation: Casablanca — Tangier — Annaba — Malta — Izmir — Ambarli — Constanta — Odessa. The service BSME involved four vessels with capacity of 1700 TEU.

In early September, Hapag-Lloyd launched a new weekly service North-Sea Baltic Service (NBS) with the following rotation of the ports of call: Rotterdam-Gdynia-St. Petersburg-Helsinki-Gdynia- Antwerp-Rotterdam. Two ice-class vessels with a capacity of 2,500 TEU each are put on the NBS.

At the very end of September, Arkas Line announced changes to the Marmara Russia Service (MRS) schedule. Taking into account the changes, the MRS service now has the following rotation of the ports of call: Mersin — Izmir – Limas — Marport — Novorossiysk. In addition, Arkas Line replaced the ships working on this service. Now it has two container ships with capacity of 2700 TEU.

It can also be noted that at the end of September the first vessel of the weekly service Intra Asia 1 (IA1), serviced by MCC Transport, a member of the Maersk group, was handled in Vladivostok. IA1 service connects the ports of Jakarta, Surabaya, Hong Kong, Shenzhen, Ningbo, Shanghai, Kvanyan, Busan and Vladivostok. On the line, six container ships with a maximum capacity of 2800 TEU are involved.

We also note that in connection with the celebration of the Independence Day of the People’s Republic of China in the first week of October and the stoppage of the whole production life for this reason, a number of flights were canceled or a certain number of flights registered in October this year were declared as blank. But how much it helped carriers to maintain the balance of supply and demand, will become clear only in the 4th quarter of this year.

Based on materials of marine periodicals