How accurate the forecasts of the development of the global container market were in the past few years, how reality «corrected» the expectations and what forecasts can be made in the current situation – this and much more in expert material on the pages of the «Shipping» magazine.

In May 2013, on the freight conference, held in Odessa, the following forecasts of the «players» of the container market in relation to its development in 2013-2016 were announced. After more than three years, it is interesting to see which of the forecasts have come true – and which have not.

- Container industry should forget about the growth of container traffic volumes at a rate of 8-9% per year, taking place in 2008. Now, in the best case, we can count on the annual growth of 5-6%.

Despite its restraint, the forecast, given above, as shown by the last three years, turned out to be overly optimistic. As early as in 2015 the lowest in the past seven years increase of container traffic volumes was recorded, to which the slowdown of the Chinese economy, as well as known issues in the European region mainly contributed. China, being the largest exporter of goods transported in containers over the years, acts as a locomotive in maritime transport volumes enhancing. According to the estimates of the main sea analysts, the growth in demand for container shipping will be in the range of only 1-3%. Most experts agree that today the oversupply of container tonnage is at a level of 30% above the demand for transportation. Calculated «Clarkson Research Services» global index of supply and demand for container shipments, which stood at 89 points in 2011, declined in 2015 to 80.7 points (100 points index means the balance of supply and demand).

Pessimistic analysts do not believe in a significant increase in demand, at least – in 2016-2017. For example, in «Alphaliner» they predict that the volume of containers traffic in the world in 2016 will grow by only 0.3%, which is the second worst result in terms of growth in the history of container traffic. It is to be recalled that even worse things were only in 2009, when in the wake of the global financial and economic crisis, traffic fell by 8.3%. «Braemar ACM Shipbroking» joined the camp of the pessimists as well; they believe that the world container shipping demand will be close to zero in 2016. In the «toolbox» of the pessimists there is an indisputable fact that the updated forecast of the World Trade Organization (WTO) says that the rate of growth in world trade volume in 2016 decreased to 1.7% instead of 2.8% previously expected. In addition, the increase in trade for the first time in the last fifteen years will be lower than the growth rate of global GDP, which according to the WTO forecast will increase in 2016 up to only 2.2%. The forecast for 2017 is revised as well: now it is expected that world trade in the next year will grow by 1.8 – 3.1%, not 3.6% as stated in the April forecast. Before the global financial crisis of 2009, the growth in demand for container shipping was about three times faster than the increase in world GDP. However, in the 2010-2014 this ratio decreased to 1.1. And in 2015 – was even less than one. Accordingly, «DNV GL» analysts predict container market recovery no sooner than in 2018. That is, the container industry will have at least one tough year. Exactly the same point of view is shared by analysts of the «Boston Consulting».

According to the «International Transport Forum», if before 2009 the growth in demand for transport and growth in tonnage had parallel courses and very little difference, after this point the gap is only increasing. Although 2016 may slightly reduce the existing imbalances as container fleet growth this year is expected to be only 2.4%, while last year the figure was 8.1%.

However, according to «Jefferies», in 2017 the increase of capacity of the container fleet will jump to 5.1% due to the planned delivery of the stocks of 31 container vessels with the capacity of over 18,000 TEU. So far, in the world there are only 42 such container carriers.

- Almost exhausted container vessels traffic speed reduction, removal of vessels from operation, and also accelerated cancellation of old shipscan resist the established imbalance of supply and demand of tonnage.

Experience has shown, that low speed containerships movement has exhausted its resources and doesn’t release from the imbalance. The shipowners had to take more substantial measures, i.e. sending vessels for the holding anchorage and massive cancellation of the container vessels for scrap.

According to the latest «Alphaliner» report, at the end of September, the number of the laid up container carriers increased to 344 units. Their total capacity was 1.2 million TEU, or 5.9% of the active fleet. The laid up vessels include 85 of the «Panamax» with capacity of 4000-5100 TEU. But this, already considerable fleet is likely to be replenished by another 25 ships of the same class belonging to «Hanjin Shipping», which has fallen into economic millstone. The capacity of the laid up ships, to the end of this year, can reach 1.5 million TEU, or 7.4% of the active fleet. So far, the maximum number of the laid up container carriers in 2016 was 357 units with total capacity of 1.54 million TEU. Among them are mega-container vessels with the capacity of over 8,000 TEU, including ships of the «Triple-E» class with capacity of 18,000 TEU. And this is a figure comparable to the anti-record in December 2009 when laid up tonnage was 1.52 million TEU.

In order to somehow reduce the excess tonnage, shipping companies are willing to send for scrap the container tonnage of the total capacity of 500,000 TEU. This is almost three times more than last year. According to «Braemar», during the past 9 months, over 126 container vessels left on the scrap with total capacity of 429.5 thousand TEU – compared to 85 vessels with a total capacity of 187.5 thousand TEU during the whole 2015. The average age of the container vessels, leaving for ship breaking, this year was only 19 years, compared with 22 years in the past year. It comes to the fact that the container ships, leaving for breaking, were built after 2000. In the reporting period, the vessel «Viktoria Wulff» with the capacity of 4546 TEU, built in 2006, left on the scrap and became the youngest ship of this class, which was sold for scrap. Sending to scrap of the 10-year-old vessel (despite the fact that the normative service life is 25 years, and until 2014 for scrap, as a rule, were sent the vessels aged 30 years and older) speaks about the depth of the abyss, in which turned out to be a container market in general and container ships of the «Panamax» class in particular.

But so far, neither noticeable increase of the leaving for scrap vessels nor container carriers sending to the holding anchorage, haven’t eliminated the existence of the market over-supply of tonnage.

- Extremely high volatility in freight rates in the container shipping observed in 2010-2012 will continue in 2013 and possibly in 2014-2015.

The last three years aggravated the situation with extremely high volatility of the spot rates in the liner shipping sector. For example, in the direction of Shanghai – Northern Europe spot rates in the period under review ranged from slightly less than 200 USD / TEU to 1,300 USD / TEU, i.e. the difference reached more than six times value.

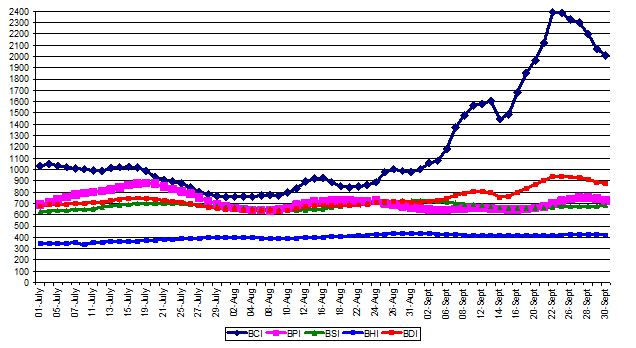

Quarterly dynamics of Shanghai Containerised Freight Index in 2016.

| The direction of the container transport | 01.01.16 | 01.04.16 | 01.07.16 | 30.09.16 |

| Shanghai – Northern Europe (Hamburg, Antwerp, Felixstowe, Le Havre) | 1232* | 339* | 1206* | 699* |

| Shanghai – the Mediterranean (Barcelona, Valencia, Genoa, Naples) | 1257* | 507* | 1172* | 583* |

| Shanghai – US West Coast (Los Angeles, Long Beach, Oakland) | 1518 | 922** | 1209** | 1686** |

| Shanghai – US East Coast (New York, Savannah, Norfolk, Charleston) | 2555 | 1787** | 1785** | 2416** |

| Composite index SCFI | 836,96 | 457,70 | 752,75 | 707,68 |

* — USD /TEU; ** — USD /FEU Source :SSE

As of the end of September, the indicative spot freight rates for shipping container from Shanghai to the ports of Northern Europe collapsed to 699 USD / TEU, returning to the same level, which took place before the reports of the collapse of the South Korean carrier. Thus, only during the 3rd quarter of 2016 the level of spot rates in the direction of Shanghai – Northern Europe fell by more than 500 USD / TEU (42%). Similarly, the indicative spot rates in the direction of Shanghai – the Mediterranean behaved, during the quarter they fell from 1172 to 583 USD / TEU, (50.3%). The only difference is that if in the beginning of July, the rates for North Europe were 34 USD / TEU, or 2.8% higher than for the Mediterranean, then in late September the gap was already 116 USD / TEU, or 16.6% .

And although, according to the analysts, the growth of the rates, due to the reduction of the capacity of the fleet in connection with the bankruptcy of «Hanjin Shipping», was to have a lasting character, it hasn’t happen yet. At least, on the spot market and in relation to European directions. For comparison, in 2014 the average level of spot rates in the direction of Asia-Europe amounted to 1165 USD / TEU, in 2015 – 620 USD / TEU, and during the 9 months of 2016 – less than 600 USD / TEU. Although at the beginning of January 2016 the rates were at the level of 1149 USD / TEU. Rate increases in the direction of Asia – North Europe / Mediterranean / Black Sea at the rate of 600-1100 USD / TEU scheduled for August, by the companies «Hapag-Lloyd», «CMA CGM», «OOCL» and some others were ignored in the market. The pronounced downward trend occurred in transatlantic traffic as well. Calculated by «Drewry» «World Container Index» (WCI) for transatlantic destinations New York – Rotterdam in the 3rd quarter of 2016 fell by 33.2%. If in the beginning of July WCI for this direction was 779 USD / FEU, in late September it fell to the level of 520 USD / FEU. And in the middle of the month – fell to 434 USD / FEU.

Quarterly dynamics of China Containerised Freight Index in 2016.

USD/TEU

| The direction of the container transport | 01.01.16 | 01.04.16 | 01.07.16 | 30.09.16 |

| Northern European services | 836,37 | 627,23 | 710,01 | 906,44 |

| Mediterranean services | 745,84 | 552,92 | 549,02 | 817,53 |

| West American services | 854,46 | 719,25 | 726,50 | 690,52 |

| Eastern US services | 749,08 | 857,33 | 793,10 | 834,67 |

| Composite index SCFI | 723,26 | 646,06 | 645,60 | 741,81 |

Source: SSE

Unlike the spot ones, in this period, the contractual rates fluctuated slightly. Their jumps usually did not exceed 8-15% in the quarter. In addition, they had a pronounced tendency to grow in the 3rd quarter of this year, as evidenced by the dynamics of the «China Containerised Freight Index» (CCFI). The growth of the composite index SCFI in the reporting period amounted to 96.21 points, or 14.9%. And two-thirds of the growth of this increase occurred in July and only one-third – in September (the index in August hasn’t changed). It says that the forced withdrawal from the market of a bankrupt company «Hanjin Shipping» did not play a decisive role in the growth of the rates, as it was in spot traffic. Such a pronounced difference in the dynamics, not to mention the level of spot and contractual rates, has created confusion in the minds of container senders – which of the systems is more favorable to use. On the one hand, the contractual rates are much more stable than the spot ones, which is one of the main principles of the normal budgeting. In addition, in 2012-2014 most of the time, for directions Shanghai – Rotterdam, spot rates were higher than the contractual ones. But in 2015 the situation changed dramatically when spot rates were generally lower than the contractual, which generally continues in 2016.

We should also note that the collapse of the «Hanjin Shipping» literally stirred up the sea periodicals. At the same time, it is so multifaceted that deserve special consideration. But whatever it was – the thing that happened to «Hanjin Shipping», one of the top ten global container carriers, has already had (and probably will have) its impact on the market in several planes. Firstly, the lines system of the company that was actively working in the European and American services collapsed. At some point, for this reason, the offer of tonnage declined, which served as the impetus for the growth of the rates. But lines-competitors quickly filled this niche, both in the main and intra-regional routes, after which the growth of the rates has stopped.

Secondly, the shippers finally saw that the low rates have a downside – when about 400 thousand TEU containers with various goods, worth about 14 billion US dollars stuck on the arrested or simply stopped «Hanjin Shipping» vessels. This has led shipowners to reiterate the lack of economic logic and common sense, when at a distance of tens of thousands of sea miles, the container is transported at a rate of 200 USD/TEU, the shippers understood the lessons and whether they made long-term conclusions. But for some time the line carriers certainly have strengthened their position in the negotiations on the level of the contractual rates.

- The best times for the global container industry may occur not earlier than in 2014-2015.

This forecast was too optimistic as well. Although there were some ups and downs – primarily in the time-charter segment of the container transport. Thanks to the successful 1st half-year, the average «Alphaliner» time-charter index amounted 64.9 points in 2015, compared with 56.8 points in 2014. «Clarksons» analysts had average time-charter index of the container tonnage in 2015 of 52.9 points, which is 12.6% more than in 2014. However, starting from the 2nd half of the year, the time-charter market moved down. This is evidenced by at least the fall of the «Contex» index from 567 points in early June 2015 to 312 points (-44.1%) at the end of September 2016. When in June 2015 the time-charter rates for the «Panamax» were at the level of 15430 USD / day., in late September 2016, they fell to 4604 USD / day., i.e. – more than three times! It may be added that with the modernization of the Panama Canal, demand on the 32 m wide «Panamax» vessels will decrease even more. Therefore, they will likely have a direct route to scrap, not to rates increase.

Dynamics of container time-charter rates in 2015-2016, estimated by Hamburg brokers ConTex

USD/day.

| Container capacity

TEU |

02.06.15 | 05.01.16 | 30.06.16 | 29.09.16 |

| 1100 | 8567 | 6612 | 7134 | 6669 |

| 1700 | 11690 | 7459 | 7332 | 6766 |

| 2500 | 13742 | 6158 | 6122 | 5764 |

| 2700 | 14427 | 6424 | 6203 | 6084 |

| 3500 | 14672 | 6008 | 5602 | 5373 |

| 4250 | 15430 | 5868 | 5094 | 4604 |

| ConTex Index | 567 | 336 | 331 | 312 |

Source:VHSS

Even more depressing picture in 2016 was for a linear segment of container transport. And a clear indication of this is declaration of bankruptcy in late August this year of South Korean «Hanjin Shipping», which is the world’s seventh largest container carrier. To this we can only add that by the end of the 2nd quarter of 2016 «Maersk Line» losses amounted $ 151 million; net loss of «CMA CGM» for the first half 2016 amounted 109 million; «China Cosco Holdings Co.» — 7.21 trillion yuan (US $ 1.1 billion.), «Hapag-Lloyd» — 142,1 million euros, «United Arab Shipping Company» (UASC) — 201,1 million, «Orient Ocean Container Line» (OOCL) — 56,7 million, etc.

According to analysts, the cumulative loss of 13 of the top 20 container lines, according to the results of the 1st half of the year, reached US $ 2.5 billion. With all container carriers, industry losses in the first half of the year, estimated by «Sea Intelligence Consulting», amounted about US $ 4 billion. According to forecasts of the same source, the cumulative loss of 20 largest container carriers in the world this year will be from 8 to US $ 10 billion. We have to recall that, according to the previously made forecast by «Drewry», container lines losses in 2016 will amount about $ 5 billion. Due to the unprecedented low rates, starting from 2014, container operators have already lost about 50 billion. On the routes between Asia and Europe for most of the 2016, the rates are kept at a level below 1,000 USD / TEU dollars, while the companies have repeatedly stated that their business becomes unprofitable at a level below 1400 USD / TEU.

According to the analysts of «Alphaliner», container carriers profitability will remain at a low level in the second half of the year, despite some recovery rates in September (due to the bankruptcy of «Hanjin Shipping»). Additional negative pressure on the profitability of transport in the second half of 2016 is given by the bunker fuel prices rising, which, compared to the end of the 2nd quarter increased by 10%. Although the situation in many line carriers is very difficult, «Alphaliner» considers future bankruptcy, similar to «Hanjin Shipping» improbable.

Dynamics of the prices for dry cargo 20-foot containers and their rates of long-term operational leasing (LTL) from 2004 to 2016

We have to note, that because of the downturn in the shipping market, container manufacturers, as well as companies who give them on lease experience very difficult times too. If containers manufacturers suffer from sharply decreased demand and low prices, then leasing companies were hit by the fallen rates of the long-term lease of the containers (LTL). As a result, three well-known leasing companies ceased to exist in 2015-2016. And their container fleet, numbering 8.5 million TEU was distributed among the other «players» of the market by mergers / acquisitions.

- Financially strong lines have more chances of surviving – and they greatly increased in the case of consolidation.

Indeed, in a severe crisis, in which the container line carriers appear, many a one see a cure out of the troubles in further acquisitions and mergers. In February 2016, China had formally completed the merger of two state shipping companies «China Ocean Shipping Company» and «China Shipping Group». In the current year «CMA CGM» acquired «Neptune Orient Lines» (NOL). The issue with the association of «Hapag-Lloyd AG» and «UASC» is almost resolved. Earlier in 2014 «Hapag-Lloyd» acquired container operations of the Chilean «Compania SudAmericana de Vapores» (CSAV). In this, maritime analysts say that none of the «players» of the container market with a market share of less than 5% is not immune from the merger / absorption – or risk of the withdraw only at the inter-regional transport. Andonly three carriers – «Mediterranean Shipping Co.» (MSC), «CMA CGM» and «Cosco Container Lines» today have market share of more than 5%, in addition to the «Maersk Line».

Projected alliances of the container line carriers in April 2017

| The name of the alliance | Major «players» | The number of vessels, units | Total capacity, million TEU | Fleet cost, billion US dollars. |

| Ocean Alliance | COSCOS, CMA CGM (incl. NOL) | 539 | 4,08 | 23,90 |

| 2M (incl.НММ) | Maersk Line, MSC | 483 | 3,30 | 16,62 |

| The Alliance | Hapag-Lloyd (incl. UASC), NYK Line | 347 | 2,70 | 16,61 |

Source: Maritime Periodicals

Another example of the growing globalization in the container industry is observed in the recent times expansion and strengthening of the system of alliances of the major carriers. Already, 16 container lines, included in the top twenty global carriers are members of the four major alliances. Currently, the container market has four major shipping alliances: «G6 Alliance», «CKYHE», «2M» and «Ocean Three». It is assumed – and certain agreements have already been reached (to be agreed with the relevant antitrust authorities of US, China and the EU) that their number will be reduced to three from April 2017.

Analysts predict that over the next ten years, the process of consolidation will lead to the fact that the market will have 8-10 global container carriers, which together will have 70% of the market. These global carriers will determine the rules of the game for all other market participants. Surely freight rates will rise, but only in the long range.

Analysts estimated that the top 25 container lines have 93% of all container shipping. As for September 2016, twenty leading line operators controlled 88% of the capacity of the world container fleet. And the share of the top ten is about 70%, which, in view of the merger of «Hapag-Lloyd» and «UASC», as well as the bankruptcy of «Hanjin Shipping», will soon grow into 75%. It can only be noted that steady pursuit of consolidation has always been a feature of liner shipping. Suffice it to recall the decades-lived system of liner conferences. It came almost at the dawn of the formation of the liner shipment, and after the conferences were banned by antitrust authorities of the European Union, has developed into a system of alliances.

Thus, until the end of the container market repartition between the newly created alliances of carriers, and it will happen no earlier than 2018, do not expect for restoration of the freight market conditions. Fierce competition in the fight for market share and the resulting freight wars will not give the possibility for the carriers to raise the rates, as if they might wish.

In conclusion, we note that the current state of the container transport market confirms completely the conclusion made three years ago, «the current downturn in the container industry is much more serious thing than the next stage of the cyclical development of the market – and the dramatic changes in the container market are inevitable». Anyway, it is difficult to expect that the accumulated imbalance between supply and demand will disappear by magic, and an era of prosperity will come in the next few years in the container market.

by Valeriy Voynichenko, Ph.D., BINSA expert