Larysa Yeroshkina

«Shipping»

In the segment of loaded container traffic volumes, 2018 is the best for the last ten years and the second after 2008 for Ukraine. Meanwhile, the shipping container market shows not so dynamic growth. In order to save the business, shipping companies keep uniting.

Roman Koloianov, General Director of Maersk Ukraine Ltd., liner agent of Maersk Line and Seago Line in Ukraine, told us about trends at the global container shipping market, increase of competitiveness of shipping companies and influence of digital technologies in his speech at the 12th Chornomorsk Container Summit held in September in Odessa.

Losses because of freight rates

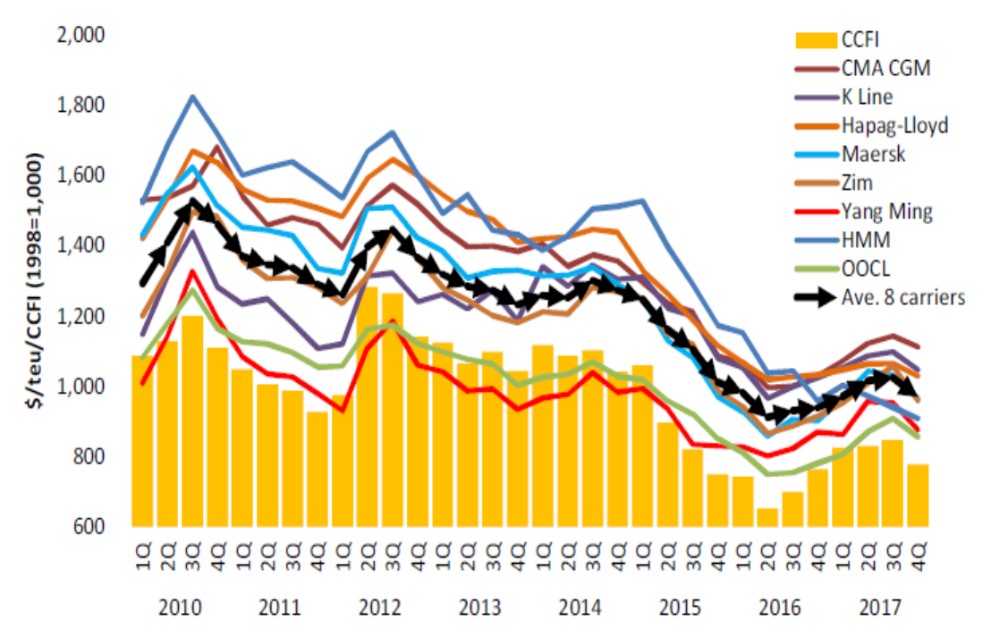

Profitability of the container business is very low today as the container lines worked with the freight rates, which were often under cost, in the last few years. A slight increase of rates (by 7.4 %) was observed in late 2017 (Diagram 1), but then they began decreasing again.

In 2018, the rate kept some positive stability, but it did not save the situation. The problem was because of the bunker fuel price started increasing rapidly. In its turn, it has a negative impact on the business profitability. It was observed that most of container lines had a serious «minus» in the first quarter of the current year, and just some companies had a small profit in the second quarter.

Diagram 1. Changes of freight rate figures from 2010 to 2017

Shipping volumes may grow up to 200 million TEU

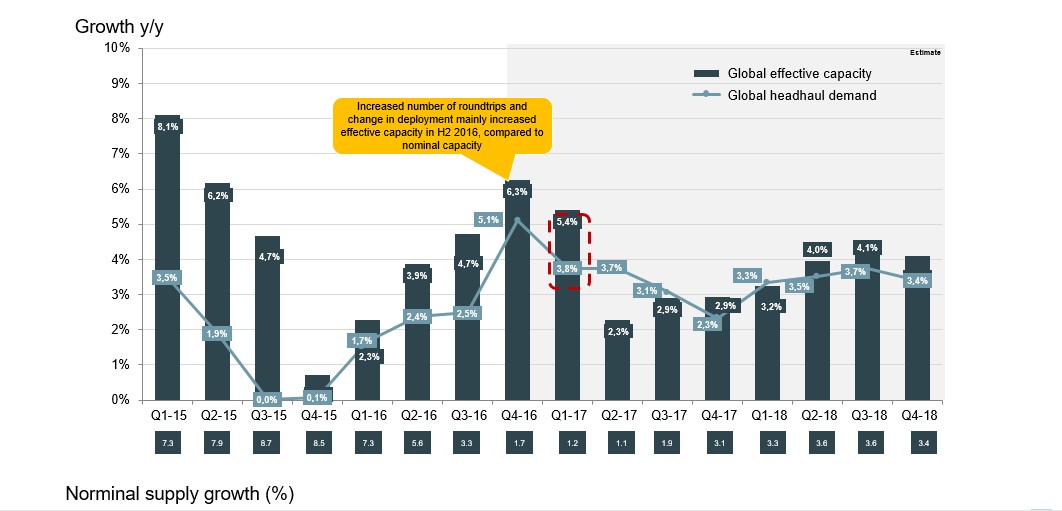

The aforementioned figures depend on the balance of demand and supply at the global container market, namely the ratio of the fleet capacity and demand for container shipping (Diagram 2).

Diagram 2. Dynamics of the demand and supply gap at the container market

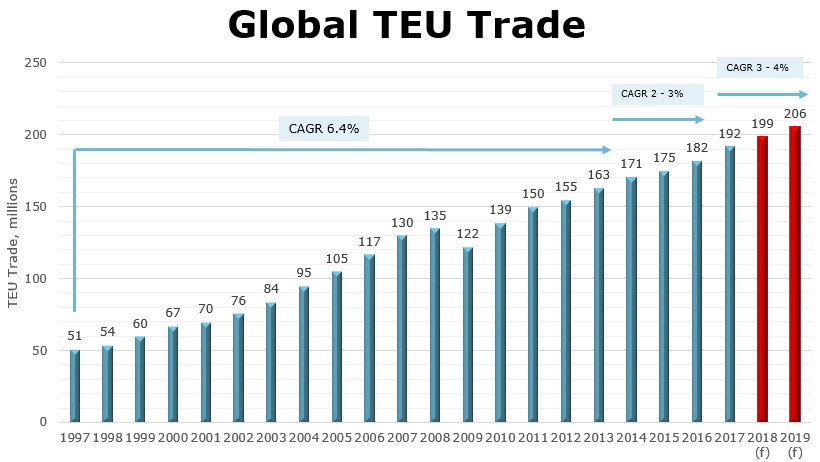

By analysing the data, it can be seen that 2012 is stable enough in that respect, but some overcapacity is observed. It is associated with the fact that there is an additional fleet that is to be launched in the current year. A thorough study of the demand and supply trends shows that from after the 90s the average demand increment was quite high, 6 % on average of the general container volume available for shipping operations every year. Gradually, the figures decreased up to 2-3 %, but since the beginning of 2017 the market actors have been expecting a growth of shipping volumes by 3-4 %. Thus, this figure may have increased to 200 million TEU by 2019 according to the forecasts (Diagram 3).

The global GDP dynamics is another indicator of a state of the global container shipping market, which has a direct impact on the financial and merchandise turnovers. If to analyse the global container market, the ratio of container flows and GDP growth is decreasing. The experts forecast the global GDP increase by 3-4 % this year. A similar trend remains in 2019 as well.

Diagram 3. Forecasted growth of demand at the global container market

Supply progress slowed down

In general, the capacity increment kept pace with the demand increment. An average increment in the container fleet is about 1 million TEU a year. But the speed of the container fleet increase slowed down, what is directly related to the decrease of orders for new vessels. In 2012-2015, there was a boom in the construction of large vessels, but today a trend toward the small-capacity fleet construction prevails. What is more, irrespective of the fact that new orders for container vessels increased almost by 40 % quantitatively, much of this increase was within the capacity range <3000 TEU, and the general supply increment in TEU is well below the period of 2013-2015 years still. Therefore, the general capacity does not go up by much.

This change in the stock of orders of the fleet is related to the fact that there is a finite number of ports in the world, which can handle container carriers with the capacity of 18000-20000 TEU. It means that there is no practical need for an additional heavy-tonnage fleet as a quite big number of heavy-tonnage container carriers have been put into service already.

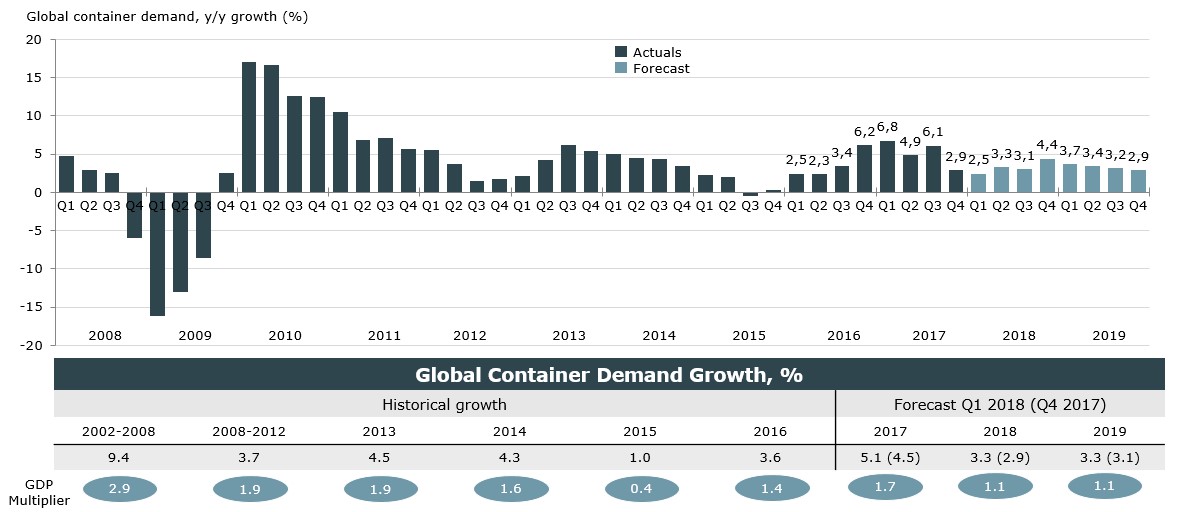

For shipping carriers, it is a positive moment in terms of the increase in profits as the supply is lower, and the demand is growing (Diagram 4).

Diagram 4. Real and forecasted figures of the demand growth

Consolidation as a way to save the business

Consolidation is a general trend observed at the container market. The main reason is that the profit margins have decreased in this business. The statistical data of 2012-2016 shows that either the profitability was at a low level for the global giants or lines specialised in niche, Asian markets. In order to hold their ground at the container shipping market, actors have to become localised or, conversely, globalised (to become consolidated), what has been happening for the last 3 years.

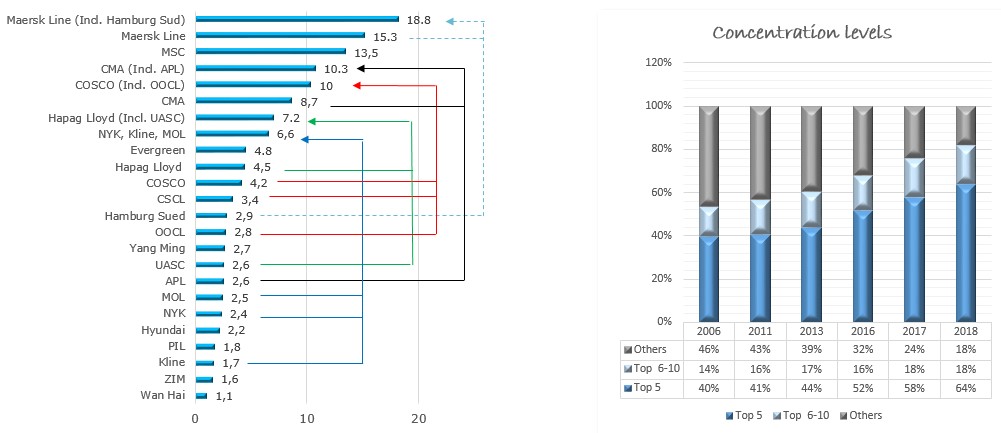

Nowadays, five leaders-shipping carriers control 64 % of the global market. Next five companies control 18 %.

Diagram 5. Trends of globalization on container the market

Globalisation goes on, and it can be seen through an example of the coming union of COSCO with OOCL.

But, in general, consolidation of our market as a process had three stages. The first stage was in the late 90s, and the second was in 2005-2008. Since 2016, we can observe the longest and the most serious stage of consolidation of container players at the global market.

The level of consolidation is determined by the consolidation index – HHI. Nowadays, HHI stopped at the level of 1016, what corresponds to the average consolidation index. From the conceptual point of view, HHI has to reach the level of 1500-2000 so to secure the market sustainability.

IT technologies in the container business

Nowadays, IT technologies headily capture the transport industry, and container lines should consider this fact so to hold their ground at the market.

If to speak about the shipping, it is now at the second stage of implementation of digital technologies. The process goes on, and Maersk understands that new technologies will have a great impact on the change of customer relations for the next five years. Deals will go into the electronic plane and be executed remotely. Digitalisation will result in the increase of productivity of assets used. In particular, the digital data processing will make it possible to predict the future more efficiently. Changes will have respect to related sectors, interactions with contractors. The main reason of all these IT transformations lies in the intention of shipping lines to optimise the expenditure side for reducing the cost of services. Maersk has three large projects based on digital technologies that are already available for clients. In particular, we are talking about the system «Remote Container Management» for controlling reefer containers. Every container is fitted with a special sensor that transmits online data about the container mode to our operating centres. Cargo owners can watch in the real-time mode what is going on with their cargo and where it is. The system also makes it possible to remotely change the mode of the refrigerating plant.

The second and equally important project is the supply chains management platform «Trade Lens» based on Blockchain technique. It is a joint project of Maersk and IBM. Thanks to Trade Lens, shipping chain participants can get a secured online access to the platform for control, documents exchanging and efficient communication with one another. Online freight forwarder Twill is another electronic platform created by Maersk, which makes it possible to promptly calculate a total cost of a transportation service «House/House», and make its order by a few mouse clicks.

Russion version: Контейнерный рынок продолжает консолидироваться